Despite the high income, many couples have financial worries

We understand the pain

You feel like you should be saving more

Your lifestyle is good, but you feel like you should be saving more. With clear financial goals, you'll know exactly how much is enough to save so you can enjoy the rest without guilt.

Uncertain about your financial future

You're moving in with a partner, planning a family, buying a home, or thinking about financial freedom, but you don't know where to start or if you're on the right track.

You’ve tried it all, but nothing feels right

Free apps are full of ads. The popular ones are too complex. Spreadsheets work, but they’re a hassle and hard to keep up with.

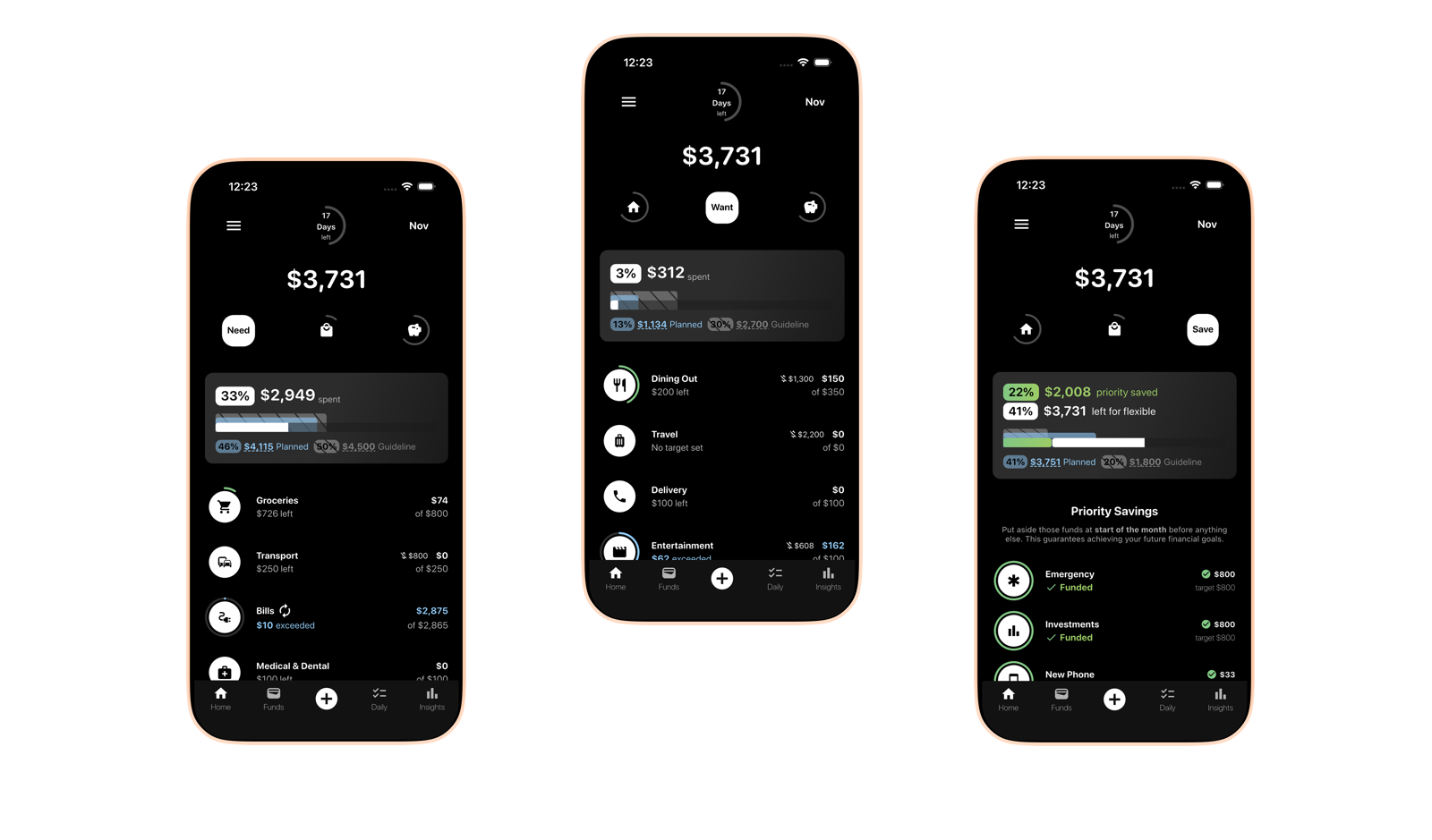

How it works

See Monnetta in Action

Watch how couples use Monnetta to align their finances and make real progress together.

All you need is a simple plan that just works.

A solution that puts you in control - no accounting degree required. How?

Set your plan in minutes

Our guided onboarding helps you build your first plan in minutes. Each month, you’ll revisit a similar version, making small tweaks as needed and gaining more confidence in your financial direction.

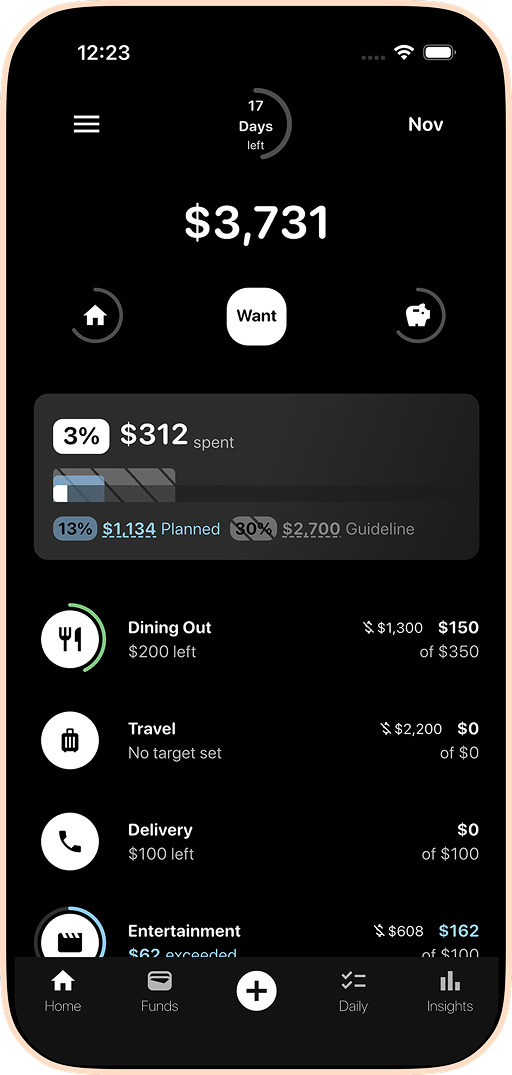

Get a clear picture of your finances

Monnetta uses the 50/30/20 method to give you a full, easy-to-understand overview of your finances without judgment, even if you're off track initially.

Stick to your plan with ease

Monnetta features one of the fastest transaction entry systems, ensuring you're regularly updated. This makes staying on track with your financial plan remarkably simple.

ONE COUPLE 💑 - One PRICE 🏷️

Pricing

1-week free trial, then $7.99 month or $59.99 year (equivalent to $4.99 month) per couple or family

Start with one week free trial. Cancel anytime.

Per couple or family via Apple or Google.

Per couple or family via Apple or Google.

What's Included?

Everything you need to take control of your money.

Ad-Free Experience

Stay focused on your goals without distractions. No ads, ever!

Shared Budgeting

Easily manage finances with your partner or family, together in one place.

Offline Access

Plan and track even when flying or without internet - syncs when you’re back online.

Custom Categories

Tailor your budget with categories that reflect your lifestyle and goals.

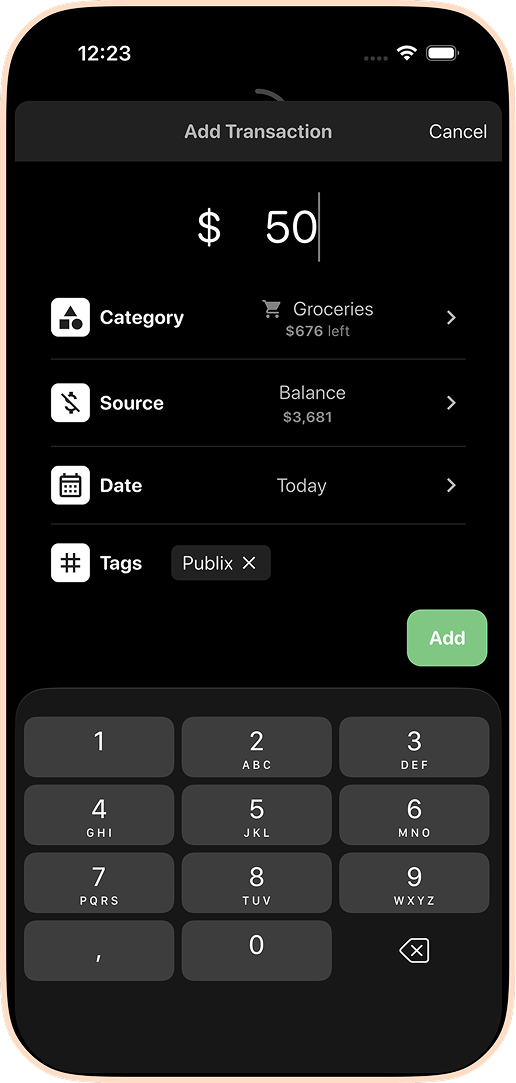

Quick Transaction Input

Built for awareness - not friction. Most entries take just 3 seconds to enter.

Proven Budgeting Methods

Combines time-tested, 50/30/20, and pay-yourself-first approaches. All in one simple app.

Easy Onboarding

Get set up in minutes with a streightforward guide designed for clarity.

Add Family for Free

Bring up to 5 family members into your budget at no extra charge.

Sometimes, all it takes is the first step.

Step 1: Download & Install

On Android or iOS, we’ve got you covered. Try it free for the first week. Cancel anytime. You’ll also get an email reminder one week before your trial ends - no surprises.

Step 2: Set Up Your Plan

With a clear, step-by-step onboarding guide, you’ll be set up in about 5 minutes. No confusion, just a simple start toward better money management.

Step 3: Ready!

You now have a full overview of your finances at your fingertips. Try to stick to the plan, but don’t worry if you miss a target or if your targets seem too far from guidelines. You’ll adapt and improve the following months.

Still not sure?

Discover if our solution aligns with your vison. Let's start with who is not for...

Monnetta may not be ideal for you if you’re looking for...

If you want a tool that manages everything on behalf of you.

If you believe that tracking past expenses alone is enough to achieve your financial goals.

We’re committed to delivering top-tier service and that means investing in the right people. If you believe excellence comes without cost, this app might not align with your expectations.

Try Monnetta if you’re looking for...

The 50/30/20 method is proved to be one of the simplest way to start budgeting effectively. Monnetta helps you stay within the guidelines for strong and balanced finances.

Balanced finances mean freedom. When wants stay under 30% of income, you can take new opportunities with confidence. Living fully today while steadily progressing toward long-term goals.

Say no to blind autopilot budgeting. Be in the driver’s seat of your finances so no tool decides for you. They’re there to simply assist you to be more productive and financially stress-free.

With quick inputs and daily rhythm, Monnetta boosts awareness and control.

Monnetta is for people who want to move forward, not just look back. You make a plan and track against it.

Shared budgeting can be tricky. Monnetta makes it simple and there’s no extra cost for family members.

Whether abroad or on a plane, Monnetta works offline. Your plan is always in your pocket.

Create your own categories and subscriptions. So everything is organized the way you want.

We’re committed to ongoing development and innovation. With a clear roadmap ahead, our mission is to make the app more effective and valuable for you. Continuous learning and improvement are at the core of what we do.

Why we built Monnetta for couples?

When we started managing money together as a couple, we felt constantly stressed—despite both earning and contributing. We couldn't figure out why.

We kept asking ourselves:

- Why do we feel anxious about money when we're doing okay?

- Should we enjoy life now or save everything for later?

- How do we make decisions together without one person always being the "bad guy"?

- We know we need a system, but where do we even start?

These questions kept surfacing until we discovered and applied the 50/30/20 method to our shared budget. It gave us both clarity and balance, helping us enjoy life today while working together toward our long-term financial goals.

What made it truly powerful was how it helped us get on the same page financially. We stopped arguing about money and started supporting each other's goals. Inspired by this transformation, we built Monnetta to make it easier for couples to see their money clearly and stick to a plan that works for both partners.

Now, more and more couples are using Monnetta to align their finances and grow together without stress or guilt.

We invite you to try Monnetta and join us in building a better financial future together.

— Yanko & Ralitsa Dieva

Subscribe for our Newsletter

Subscribe to our newsletter today and instantly receive your FREE 50/30/20 Budgeting Google Sheet! Plus, you'll receive our latest blog posts and valuable financial tips directly in your inbox.

FAQs

Frequently Asked Questions

Dive into the following questions to gain insights into the powerful features that Monnetta offers

How do I get started?

To get started, download the app and complete the onboarding steps.

Can I add my own categories?

Yes, absolutely! You can add as many categories as you like, but we recommend keeping it simple.

How many people can I add from my family?

You can add up to 5 people to a family budget.

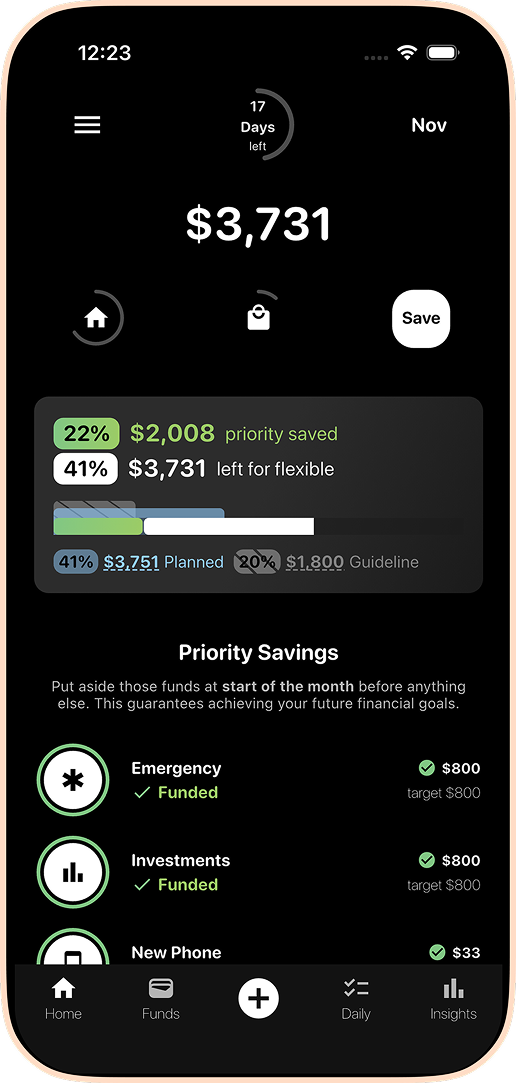

How does the "Pay Yourself First" feature work?

In Monnetta, "Pay Yourself First" is called "Priority Savings". These are treated with the highest priority, before other expenses.

What if I receive my salary in the middle of the month?

In that case, you’ll need buffer money - enough to cover your expenses (ideally double) until your salary arrives. This ensures you can plan for the entire month, regardless of when you get paid.

Are there subcategories?

Yes and no. You can add a sub-item under a category, but it functions more like a recurring transaction, such as a fitness subscription, Netflix, or utility bills. Even if the amount varies slightly, it helps with monthly budgeting predictions.